owe state taxes because of unemployment

For the 2020 tax year however the American Rescue Plan Act allows single taxpayers with modified adjusted gross income of less than 150000 to exclude up to 10200. Weve heard from people all over the state facing the same issue including christinas husband joe who says hes been employed the entire time never received an.

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

You had all the documentation.

. Ad two states only tax a portion of unemployment benefits Indiana and Wisconsin. Yes you can owe taxes on unemployment payments because unemployment is taxable income. You had other income separate from unemployment.

Yes you can owe taxes on unemployment payments because unemployment is taxable income. If your state of residence collects income taxes you may have to pay taxes on your benefits to both state. Do you have to pay state taxes on unemployment.

Similar to receiving a W-2 or 1099-MISC tax form with your wages and income your state will send you a form 1099-G with a detailed record of total benefits received for. Legislation proposed by two Democratic Senators on February 2 hopes to prevent this by waiving taxes on the first 10200 of unemployment benefits a person received last. The usual reason for owing state tax is that you did not have enough withheld from your paychecks---or perhaps from your unemployment.

You received more than 10200 in unemployment benefits and so you owe income taxes on that extra amount. If you live in one of the seven states that dont have state income tax at all you shouldnt see any indication that you owe the state income tax. Yes they can take both state and federal refunds.

When Gale Nichols received her tax forms last month she was in shock. According to Experian you could be taxed federally on your unemployment insurance anywhere from 0 to 37 percent. Higgins proposes expansion of Historic.

To stay on top of this issue you should adhere to your Form 1099-G which you will receive from the IRS in the mail that will tell you how much you must report in. Any money that you receive is subject to federal or state tax or both. If you received unemployment income in 2021 you.

Depending on the state you live in you may owe state taxes from unemployment benefits as well. Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. It depends on what state you live in.

It depends on what state you live in. However New Yorks withholding on unemployment is 25 while the actual income tax owed would be 4. Even though she opted to have California withhold 10 of her unemployment benefits.

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. Because of this CNBC reported that millions of people didnt owe any tax on their 2020 benefits or owed a lesser amount. Report unemployment income to the IRS.

The unemployment exclusion specifically said you didnt have to pay taxes on the first 10200 of unemployment compensation drawn in the year 2020. At the federal level thats also true. In Massachusetts he said estimated revenue from income taxation of unemployment benefits could amount to 78974 million on the federal share and 33069.

Ad File unemployment tax return. June 4 2019 226 PM. Some states dont tax unemployment while others provide the option to.

So far the refunds have. Check all of the data you entered. In every other state unemployment benefits are treated as regular income.

When she filed taxes for 2020 Freed discovered she owed New York State 1200 for income taxes on unemployment benefits. 45201 Research Pl Ste 100. State Unemployment Insurance Compensation debts are now eligible for referral to Treasury Offset.

The maximum weekly benefit at 504 dollars is. The Executive Office of Labor and Workforce Development submitted a. There are thousands of Massachusetts residents in a similar situation.

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Anyone Who Got Unemployment This Year Be Prepared To Owe The State Under Withheld On Unemployment R Nyc

Is The Extra 600 Unemployment Check Weekly Your Money Questions Answered

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Taxes Will You Owe The Irs Credit Com

Unemployed Workers Could Get A Nasty Surprise At Tax Time

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Why Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be Cnn Politics

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

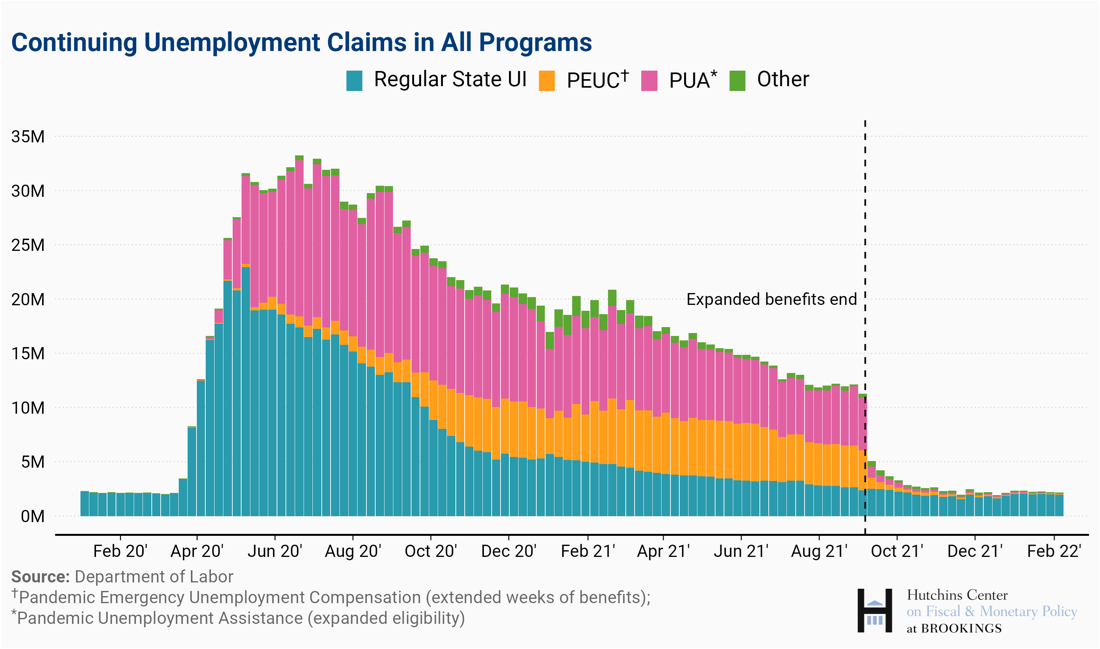

How Does Unemployment Insurance Work And How Is It Changing During The Coronavirus Pandemic

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

How Unemployment Benefits Can Affect Your 2020 Taxes

I Filed My Return On 2 24 It Was Accepted On 2 25 And Approved On 2 26 I Received This Message See Below But I Don T Owe Child Support Unemployment State Taxes Or Any Other